08

Types of Mutual Funds

Based on their characteristics, mutual funds fall into two categories: (1) Open-ended funds and (2) Close-ended funds. An open-ended fund is a collective investment scheme that offers its unit anytime until its maximum offering unit and buys back anytime too, while a closed-ended fund is a collective investment scheme that only offers and buys back its unit in specific periods. Open-ended funds in the form of KIK make up the largest portion of mutual funds by value in Indonesia today.

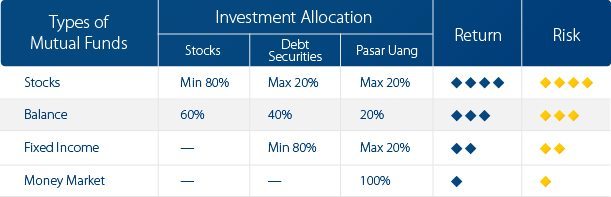

In general, an open-ended fund can be classified into four categories based on its investment allocations. These are:

- Money Market Funds: a mutual fund with assets entirely allocated in money market instruments, such as bonds with a maturity date of less than one year, deposits, and Bank Indonesia Certificates (SBI).

- Fixed Income Funds: a mutual fund with a larger portion of assets allocated in fixed income securities, such as bonds.

- Balanced Funds: a mutual fund that provides a combination of more than one underlying investment asset class, such as equities/stocks, bonds or money market.

- Equity Funds: a mutual fund with a larger portion of assets allocated in equities/stock.

In addition to the four types of open-ended funds mentioned above, there is another type of mutual fund called Capital Protected Fund. A capital protected fund is a close-ended fund that offers its unit over a certain period of time and is armed with a specially designed scheme to protect an investor’s initial capital. A capital protected fund could be the right investment instrument for an individual with a conservative investment risk profile and who seeks more measured returns over a certain period of time.

Before committing yourself to investing in a Mutual Fund product, make sure you are well informed of the mutual fund product you plan to invest in. How? Ask the investment manager that manages the mutual fund for the prospectus of the product. A mutual fund-related prospectus is an official legal document that provides details about the investment objective, investment manager, custodian bank including fee and expenses charged by the mutual fund. The prospectus is commonly available for download at the website of the investment manager that issues the product. Perusing a mutual fund prospectus allows one to get familiar with the collective investment scheme an investment manager offers.