14

Needs in Life Stages

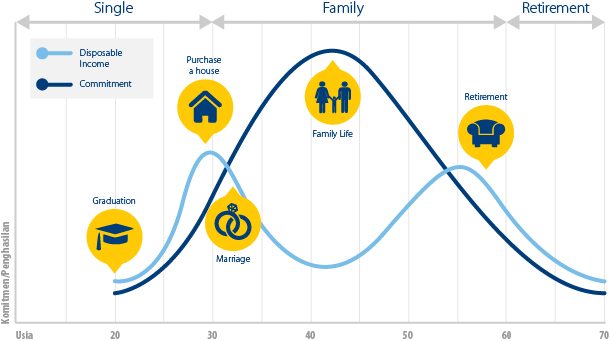

Prior to investing, you should have an idea of what your financial needs are in each stage of life. By understanding those needs, you will be able to determine the goal of investment as well as prepare a more detailed and proper investment plan.

One’s life is marked with several watershed moments, such as graduating from the university at the age of 22-25, getting married at the age of 25-35, having the first child around the same age, and entering retirement at the age of 55. Every stage of life poses different financial needs and unique challenges.

Such challenges should be overcome properly. The needs around taking care of a young child and sending them to primary school differ from future needs at the age where the child is ready to go to a university. We should realize that the amount of income and expenses would not always be in proportion.

As we grow older, especially when nearing or passing an important stage in life, we should be wiser in managing our finances. Be wiser in saving money, managing spending, and investing. Keep in mind the old adage: “It’s not how much you make that matters – it’s how much you spend.” It is so that we are able to meet life’s growing necessities every year. Having a long-term financial plan is highly recommended. Don’t let yourself fail financially in one of the stages of life and let your dream slip away.