06

What Is Mutual Fund?

Watch this short video explaining the basic concept of Mutual Fund.

Mutual Fund is one of the investment alternatives for financial assets. Mutual Fund is known as “Reksa Dana” in Indonesia.

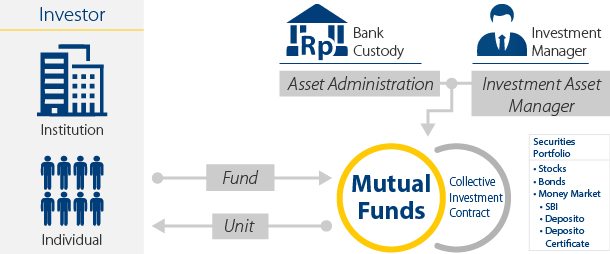

Mutual fund is a collective investment scheme pooled by a Fund Manager from institutions or individual investors to be managed professionally. This type of fund management is aimed at providing capital gains to investors over a period of time. Mutual Fund is regulated under Law of Capital Market Year 1995.

Investment portfolio of mutual fund can consist of securities such as stocks, bonds, money market instruments, or a combination of these securities.

How does Mutual Fund work?

Currently, the type of mutual fund available in Indonesia is in the form of a collective investment contract (KIK). The mutual fund is established from a collective investment contract between an investment manager and a custodian bank with their respective roles. After a mutual fund product is established, investors, whether individual or institutional, can invest their funds into the product. The investment manager is responsible to manage the collected investment fund by placing it into a securities portfolio such as stocks, bonds and money market instruments. Meanwhile, a custodian bank, which is a part of banking services, is responsible to keep investor’s funds and/or investment portfolio, settle the transaction and administration of mutual fund. The separation of functions between a fund manager and a custodian bank is aimed at maintaining investors’ safety while investing in mutual fund.